If you participate in a traditional pension plan (also known as a defined benefit plan), your plan may offer several payout options including “qualified joint and survivor annuity” (QJSA) if you are married. A QJSA is an annuity that pays a dollar amount (usually monthly) for the rest of your life, with at least 50% of that amount continuing to your spouse after your death. However, if your spouse consents in writing, you can waive the QJSA and elect instead to receive a single-life annuity. With a single-life annuity, payments are made over your lifetime but stop upon your death. For example, if you receive just one payment after retirement and then die, the single-life annuity would end, and the plan would make no further payments.

Why elect a single-life option instead of the QJSA?

The single-life annuity generally pays a significantly larger pension benefit than the QJSA. That’s because the payments are designed to last for one lifetime instead of two. Pension plan participants who want to maximize their monthly retirement income are often tempted to choose the single-life annuity for this reason. However, most pensioners are also concerned about providing for their spouses if they should die first.

What is pension maximization?

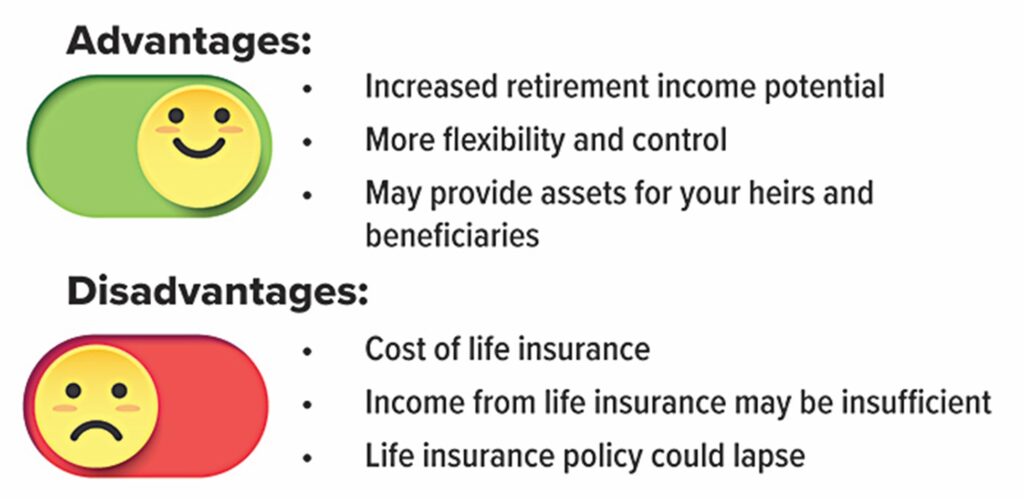

Pension maximization is a strategy that may help solve this dilemma. The way it works is that your spouse waives the QJSA and you elect the single-life annuity. You then use the additional pension income to purchase insurance on your life, with your spouse named as beneficiary. If you die first, the pension payments will stop, but your spouse will receive the life insurance death proceeds free from federal income tax. The idea is that by coupling the larger pension payments with the purchase of a life insurance policy on your life, you may be able to increase your total income during retirement, while also providing for your spouse’s financial future if you die first.

Is pension maximization right for you?

There are a number of factors to consider. Are you insurable? If not, pension maximization is not a viable strategy. How much will the life insurance cost? (If you are relatively young and in good health, the insurance premiums may be much more affordable than if you are older and/or in poor health.) How much more does the single-life annuity pay than the QJSA? The larger the benefits under the single-life annuity, the more life insurance you’ll probably want to buy. (Also make sure to factor in any cost-of-living adjustment the pension plan may provide when analyzing your payment options.) How healthy is your spouse, and what is his/her life expectancy?

Are there income tax considerations?

The monthly retirement benefits you and your spouse receive from your pension are generally treated as taxable income, subject to federal (and possibly state and local) income tax. This is true regardless of whether you elect a single-life annuity payout or a QJSA. However, since the pension benefits are larger with a single-life annuity, electing that payout option will increase your taxable income during retirement. If you elect the QJSA payout, when the first spouse dies, the pension payout to the survivor will be included in the survivor’s taxable income.

If you instead use the pension maximization strategy and die before your spouse, the life insurance death benefits will not be included in your surviving spouse’s taxable income, because life insurance death benefits generally pass free from income tax to the beneficiary of the policy. Any earnings from investments of the life insurance proceeds by your surviving spouse (e.g., interest, dividends, and capital gains) may generally be included in your spouse’s taxable income.

The pension maximization strategy is not for everyone, but it could be worth considering as you and your spouse evaluate your pension benefit options. (Note: Any guarantees associated with payment of death benefits, income options, or rates of return are based on the financial strength and claims-paying ability of the insurer. Policy loans and withdrawals will reduce the policy’s cash value and death benefit.)

While life insurance proceeds are generally free from income tax to the beneficiary, estate taxes are another matter. If this is a concern, you should consult a qualified estate planning attorney for appropriate strategies.

Be sure to seek qualified professional guidance, since choosing a pension payout option and life insurance coverage can be complex and will impact both your financial future and your spouse’s.

Information presented here has been developed by an independent third party, Broadridge Investor Communication Solutions, Inc. Commonwealth Financial Network is not responsible for their content and does not guarantee their accuracy or completeness, and they should not be relied upon as such.