As I wrote in yesterday’s post, we seem to have moved past the pandemic in many ways, but I realized it has been some time since I did an update on what that means. So here we are. Things are bad from a medical perspective, and the big question is whether medical conditions will continue to worsen to the point they affect the economy and markets. Right now, that does not look likely. I will be keeping an eye on the situation, however, and do another update when the answer becomes clearer.

The most recent data shows that the Delta variant of the virus has led to a new wave of infection growth that is worse than any of the initial waves. But it is not (yet) as bad as the third wave. The medical impact has been severe in many areas, although limited in its geographic spread. The economic damage, as we discussed briefly yesterday, has been limited so far.

The country is still reopened, and the economy is growing. Still, there are signs risks to this scenario may be rising.

The good news is that vaccination rates are going up, which should help control the rising medical risks. Conditions at the national level remain stable, as most of the recent outbreaks have been localized. With more vaccinations and appropriate public policy, these outbreaks are containable.

From an economic perspective, the news remains good. The rising infection rates have not yet translated into more economic restrictions. Job growth remains strong, layoffs continue to trend down, and confidence and spending are high. While medical risks are rising (along with some signs of slowing), the economic news remains good. We do need to pay attention, however.

So far, at least, markets are clearly discounting the risks, as they remain close to all-time highs. Furthermore, with corporate earnings continuing to do well, there may be more upside ahead. Let’s take a look at the details.

Case Growth Levels Above Initial Waves

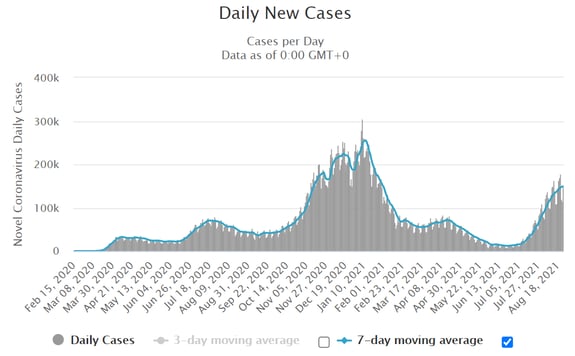

New cases per day. The most obvious metric for tracking the virus is daily new cases. The seven-day average of new cases per day was 148,755 on August 24, up from 55,210 a month earlier. These numbers represent an increase of 170 percent, as well as a trend back to levels last seen in the third wave.

The case growth can be seen as a national wave—as infection rates are up across the board—but the primary medical risks remain concentrated in areas with low vaccination rates. In the areas affected most, however, rising vaccination levels and changing public policy and action may be moderating infection growth. As you can see in the chart below, the growth rate has slowed and may be topping out (although a peak is not yet clear).

Source: https://www.worldometers.info/coronavirus/country/us/

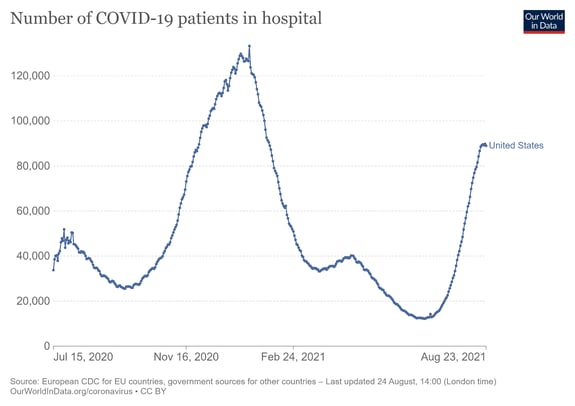

Hospitalizations. We also see the significant deterioration in the hospitalization data. As with new cases, hospitalizations are trending back to levels we last saw in the third wave. On August 22, 89,800 people were hospitalized, up from 28,571 a month earlier, which represents an increase of 214 percent. Hospitalizations typically lag case data, so a further substantial increase in hospitalizations is likely.

Source: https://ourworldindata.org/covid-hospitalizations

Source: https://ourworldindata.org/covid-hospitalizations

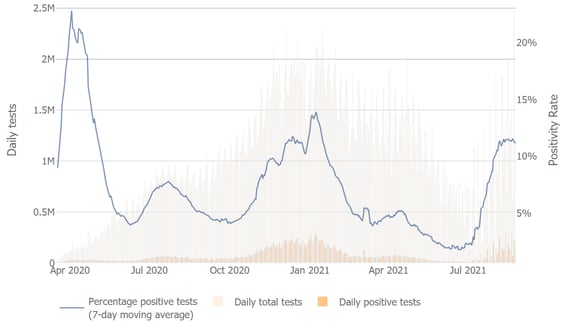

Testing news. The testing news is also getting worse, although there are signs of this trend topping out, in line with the recent slowdown in new case growth. Overall, however, testing numbers have spiked back up. This is reasonable given the increase in the number of cases and a positive test rate that has risen to more than 10 percent. These levels, which we have not seen since April, signal widespread infection exposure and a growing viral spread.

Source: The Johns Hopkins University

Source: The Johns Hopkins University

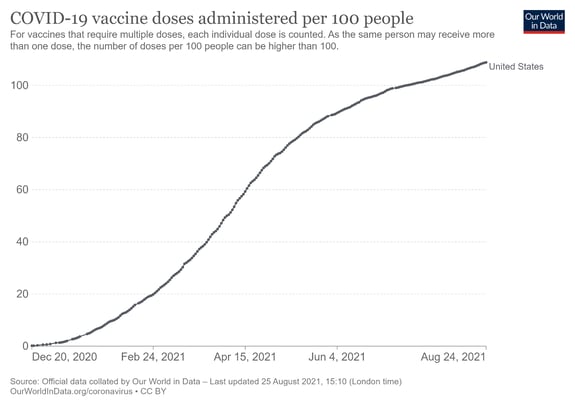

Vaccinations. The deterioration in the medical news has been at least partially due to a slowdown in vaccinations. The good news is that vaccination progress has accelerated again, although it does remain below earlier levels. As of August 24, 60.4 percent of the U.S. population has had at least one dose of the vaccine, up from 56 percent a month earlier.

Source: https://ourworldindata.org/covid-vaccinations

Source: https://ourworldindata.org/covid-vaccinations

Job Growth Continues to Improve

Despite the medical news, the economic data continues to get better overall. Job growth continues to improve, while layoffs continue to edge down and job openings go up. Consumer and business confidence remain high. Despite recent signs of some weakening, spending and investment are healthy. Overall, the economy remains open, and growth continues.

Financial Markets Still Hitting New Highs

Despite the rising case counts, the markets saw more new all-time highs in the last month, supported by much-better-than-expected corporate earnings reports. As noted in yesterday’s post, with spending strong and earnings growing, both the economy and markets are largely looking through the medical risks. Whether this scenario continues will be one of the key things to watch in coming weeks.

Country in a Better Place Overall

Over the past several weeks, we have seen the medical risks continue to rise as infection growth has accelerated. So far, these risks remain focused in areas with low vaccination rates, and the likelihood of a national shutdown remains low. The country remains open, amid a growing economy. This environment is likely to continue, unless medical conditions get much worse. The markets continue to do well and may experience some more upside ahead.

Even as we keep an eye on the risks, we remain at a place where they are specific rather than systemic. We are seeing severe localized outbreaks, but they are limited throughout most of the country. We are seeing glitches in some markets—labor and supply chains—but, in general, conditions are improving. This is what is driving the financial markets. Overall, although risks are rising, and we need to be conscious of them, we are in a much better place than we were only a couple of months ago.

© 2021 Commonwealth Financial Network®

© The Axial Company. All Rights reserved. 5 Burlington Woods, Suite 102 Burlington, Massachusetts

Disclosure: Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Barclays Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg Barclays government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg Barclays U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.